0% Financing May Hurt Credit Score

One of the ways consumers may manage their credit card debt is by understanding the various aspects of the credit offers being made. A great example – zero percent financing deals – may not be as great as they seem. The offers are everywhere, but the two types you hear most about are from Retailers or Banks and for Credit Card Balance Transfers.

While initially you may think it is a convenient way to help purchase things you need, allowing you to pay for them over time without incurring interest charges – like receiving free money for 12 months – and that may be true.

When used properly, these deals work well, but they can actually harm your credit score in a number of ways.

When used properly, these deals work well, but they can actually harm your credit score in a number of ways.

Retailer or Bank 0% Finance Offers:

- The store may actually open a credit card in your name for the exact amount of your purchase. Then, the retailer maxes out the card with your purchase price. This alone can hurt your FICO score, and that is bad.

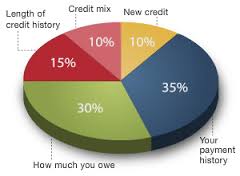

- If you are applying for new credit from a bank or a credit inquiry is made by a Retailer, this can hurt your credit score. The more often you request new credit in a short period of time, the worse your score is impacted. Since these inquiries remain on your credit report for up to 2 years, they can hurt your credit score for the first 12 months.

- Whenever you open a new account (whether a bank credit card, or a retailer opens a credit card in your name), it is eventually reported to the credit reporting agencies. This lessens the average age of your credit file. The length of your credit history amounts to about 15% of your credit score.

- Thirty percent of you FICO score is based on data that include your utilization ratio. The utilization ratio is equal to the amount of unpaid credit card balances as a percentage of the credit card limits in your name. In order to keep your credit score in the 700s, you must keep this utilization under 10%. If you pay off the full amount in one month, your utilization ratio will only be impacted for that month, and that shouldn’t cause too much trouble. The real problem occurs when you decide to let that balance sit for 11 months, paying it off in the 12th After all, why not? You are not being charged any interest on it. You do not want to do this because you are creating what is called stagnant debt during those 11 months. So, for that entire 11 month period your credit card shows a maxed out credit card, and that hurts your credit score.

Better to Rein In the Temptation

So, as tempting as these Retailer and Bank deals may be, it is probably best to only use them if you will be paying off the entire balance within the first thirty days. Then, you leave your credit report and credit score out of the equation.

0% Balance Transfer APR Credit Card Offers:

- By transferring debt from a card with interest to a card with 0% interest, you can help stop some of the financial bleeding. Since you are not adding debt, but simply transferring existing debt from one credit card to another, you will not be impacted by any of the situations mentioned above. It may be a good idea to cut up both the old card and the new card. This way you will not be tempted to add new debt, thus increasing your financial woes.

Be sure to read all the fine print on these offers, especially under terms and conditions. First, you may be charged a balance transfer fee, and it could be significant. No matter how much this fee amounts to, it must total less than what you would be paying for interest on the old credit card. If you find an offer with a zero balance transfer fee, grab it. While these used to be abundant, they may now be very difficult to find.

Be sure to read all the fine print on these offers, especially under terms and conditions. First, you may be charged a balance transfer fee, and it could be significant. No matter how much this fee amounts to, it must total less than what you would be paying for interest on the old credit card. If you find an offer with a zero balance transfer fee, grab it. While these used to be abundant, they may now be very difficult to find.- Keep your old credit card account open even though you are no longer charging debt to it. This way your credit score cannot be damaged.

- Pay off the transferred balance as fast as you possibly can! Always pay it off completely before the APR goes to the normal rate, or you may be responsible for retroactive fees and interest; ultimately costing you more in total than if you had never transferred the balance from the old credit card in the first place.

Always do everything you can to keep your credit score healthy, because this score determines how much interest you will be charged on future credit purchases, as well as larger loans for cars and houses.

Please Note: This information is for educational purposes only. For specific advice, please contact a qualified professional.

Login

Login