Are you suffering Creditors Harassment during this crisis?

‘I have no money’: harassing debt collection calls continues despite pandemic

Helen Stone was at home in New York City last week, laid off from her job amid the Covid-19 pandemic and, as instructed by New York’s governor, trying to minimize her contact with others to halt the spread of the virus.

When supplies ran low she sent her teenage children to the grocery store only to discover her debit card wasn’t working. She checked her account. It was thousands of dollars overdrawn.

Mrs. Stone suspected fraud and after spending hours on the phone with her bank trying to find out what happened, she was informed a court judgment had been made against her by a creditor to garnish her wages directly from her bank account for credit card debt she accrued a few years ago while her husband, who is now disabled, was experiencing a debilitating illness.

“I didn’t know anything about the wage garnishment until it was posted on my account,” said Stone. “I have zero funds. I have no money. I’m at the breaking point.”. If this story looks very similar to yours, then you are not alone.

The vast majority of consumer debtors have no legal representation and often are not given notice they face a lawsuit.

With the coronavirus the debt collection agencies and banks shouldn’t be allowed to harass and garnish bank accounts while we are in this crisis.

Here is how you might stop debt collection calls the smart way

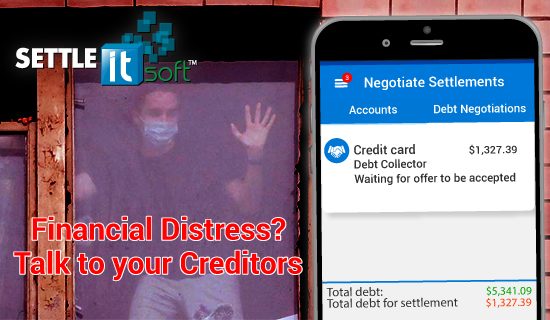

SettleiTsoft® facilitates the communication between you and your creditors. You may stop the widespread problem of continuous harassment by creditors’ predatory collection practices even in this crisis.

First and Foremost – The Law Is On Your Side

Under the Fair Debt Collection Practices Act, debtors have the right to request in what manner and when creditors may contact them.

By utilizing the SettleiTsoft platform, you are establishing this electronic method of communications as their preferred manner of negotiation. Therefore, it should stop collection calls from creditors and allow the debt obligation to be amicably resolved.

How It Works

Enter your debt to the Web App or Phone App. You and your creditors can accept, reject, or make counter-offers to the settlement proposals for any type of delinquent debt.

Starting the settlement process is easy. First, sign up at settleitsoft.com. Second, add your debt accounts and your creditor’s information. And third, start debt negotiations by sending Cease and Desist Letters and settlement proposals to your creditors.

The system conveniently generates cease and desist letters upon the subscriber’s request and automatically cloud stores all documents related to the settlement process. The user may also upload any other document to be stored in the system.

Powerful financial management tools are at the subscriber’s fingertips to provide budgeting, planning, and other support.

Why It Works for you

Accessed via settleitsoft.com, this is a real, free debt negotiation program in which the settlement amount, time frame, monthly dollar amount to deposit into a dedicated settlement savings account, and all other aspects of this digital settlement process are totally in the consumer’s control.

SettleiTsoft…

- Helps you Combat Predatory Collection Practices

- Validates the Collection Company to Avoid Debt Collectors Scams (Does it actually own your account?)

- Is Always in your Control

- Intuitive and User Friendly Assistance

If you’re ready to re-take control of your financial life, SettleiTsoft is ready to help you make it possible.

Download the phone application and Sign Up for your FREE subscription account Now!

Disclaimer:

The information provided in this article does not, and is not intended to constitute legal advice; instead, all information, instructions, content, and materials available in this blog are for general informational purposes only, designed to help the user cope with settling their debts.

Login

Login